Table of Content

Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered. Damage caused by smog or smoke from industrial or agricultural operations is also not covered. If something is poorly made or has a hidden defect, this is generally excluded and won't be covered. It will cover a foundation leak only if the leak occurred due to a covered cause. For example, if the plumbing in the soil surrounding the home leaks and cracks the foundation, the underlying cause is a covered plumbing issue.

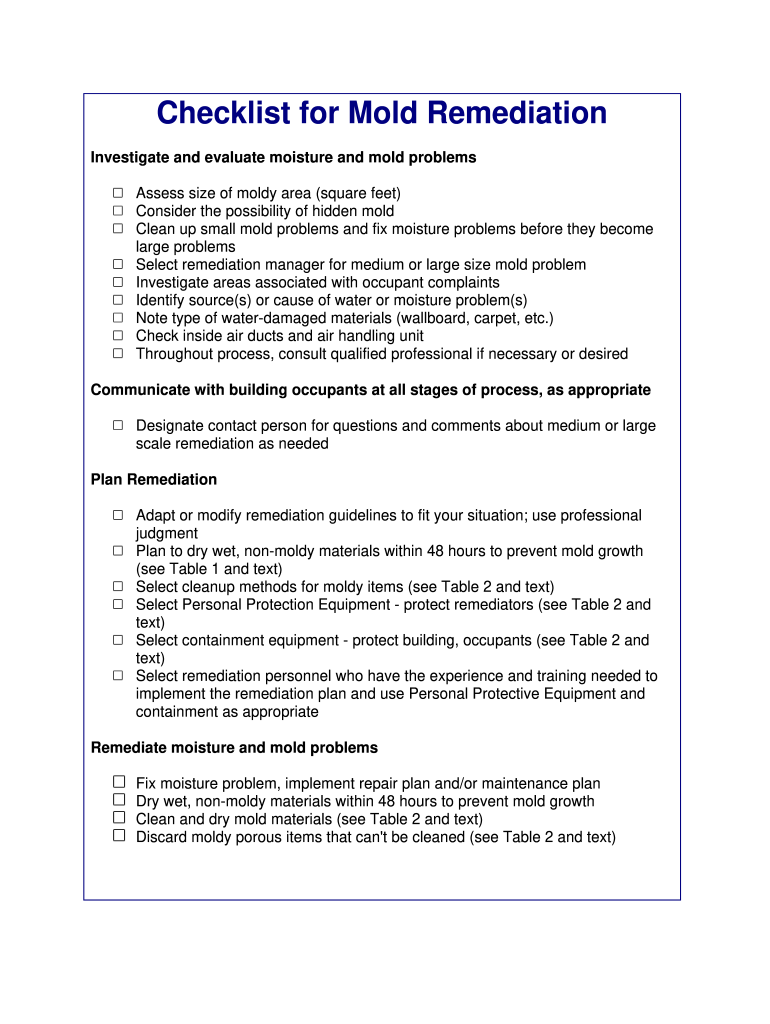

Mold formation is relatively gradual and â in its worst form â takes several months of accumulation before you realize it’s caused irrevocable damage to your drywall and flooring. At that point, it may be difficult for you or your insurer to correctly identify the exact cause of the mold and they may chalk it up to neglect or pre-existing mold growth. However, while a burst pipe that creates mold may be covered by your insurer, mold that comes from pipes connected to an improperly working AC unit may not share the same coverage. Another key way to prevent mold growth is to identify it before it has the chance to spread. The larger the infestation, the more costly it will be to remediate. Mold can hide behind your walls, under your carpets and behind your fridge.

When is Mold Covered by Homeowners Insurance?

Your dishwasher malfunctions and floods your kitchen, resulting in mold growing along the base of your cabinetry. Depending on your insurer, you may be able to file your claim online, through an app or by phone. Make a claim.Call your insurance provider immediately to make a claim. Keep a log of detailed notes of every conversation with your insurance provider and who you spoke with.

For example, if your basement is flooded, you can remove wet carpeting. Keep receipts for all purchases related to cleanup and repairs. Information provided on Forbes Advisor is for educational purposes only.

How To Address Mold In House

An example would be water damage from a burst pipe that then leads to mold. If your mold damage claim is covered, ensure only the applicable charges go toward the mold remediation limit. For example, if your laminate floor costs $2 per square foot to replace without mold and $2.50 per square foot to remove with mold, only $.50 per square foot should be charged to your mold limit. Your home insurance won’t cover you for mold damage if mold forms in your shower or a burst pipe in your basement goes unnoticed and results in mold. If the mold was caused by water damage or a covered peril, for example, you can claim this on your insurance.

Mold remediation isn’t going to be covered by your policy if its caused by neglect or lack of upkeep. Usually, if the mold growth or damage in your home resulting from covered damage and you can provide an actual link between the two, you may receive enough to cover for mold removal and remediation. This may include the cost of mold testing, repairs, replacements, disposal, and clean-up.

Does Homeowners Insurance Cover Mold Or Black Mold

Remember, standard homeowners insurance does not cover damage due to negligence. If mold in your home resulted from a lack of maintenance, it won’t be covered by your policy. Either way, mold remediation is an expensive procedure, so check your coverage limits to make sure you’re protected.

This could include water damage from a burst or frozen pipe, fire extinguishing efforts, or a malfunctioning appliance. In most cases, if mold results from a sudden and accidental covered peril, such as a pipe bursting or the dishwasher overflowing, the cost of the mold remediation should be covered. Thats because technically the pipe burst or faulty dishwasher is the reason for the claim not the mold itself. For instance, let us assume your insurance covers water damage . Then molds appear because your walls were saturated from the water overflow. Your insurance will possibly cover the cost of restoration for such a mold problem.

Mold caused by negligence

Some insurance companies, like State Farm, have dropped coverage for mold altogether, even if it's a result of storm damage. However, there are still some large national insurance companies that provide coverage for mold. In some cases, your mold claim will coincide with the claim you file for a causal incident.

If not, your state insurance commissioner may be able to offer help on what you can do to get the claim approved or to file a complaint about denial. This is not an exhaustive list, so be sure to check the included covered perils before taking out your insurance policy. Believe it or not, there was once a time where insurance carriers covered mold and mold removal much more liberally than they do now.

Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Policygenius Inc. (“Policygenius”), a Delaware corporation with its principal place of business in New York, New York, is a licensed independent insurance broker. The information provided on this site has been developed by Policygenius for general informational and educational purposes.

Undetected moisture that is present persistently can cause a lot of problems, which can result in the growth of mold. The moisture that results in the build-up of mold can be due to humidity, roof leaks or flooding. It’ll depend on the extent of the damage and buildup of the mold, but mold removal may cost anywhere from $1,000 to $10,000, with severe cases costing up to $30,000.

As with any other type of issue, though, there are some types of mold that can be more hazardous to your home and health than others. USAA typically won't pay for damage related to mold or dry rot, but you may have limited coverage if the cause of the mold is a disaster covered by your policy. Insurance is only provided in the case where a covered peril is the root cause of the mold. Say there is mold due to a pipe bursting, which is covered by your insurance. This is because the mold has been created due to the pipe bursting.

No comments:

Post a Comment